rpk GROUP’s work with colleges and universities often begins with a benchmarking analysis. Why? Quite simply: context.

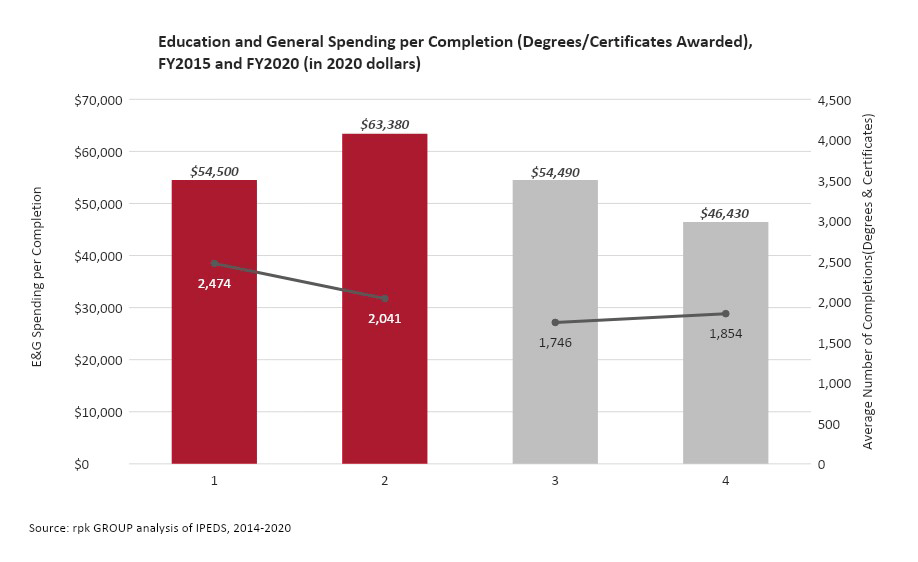

We examine a set of key metrics around employment, student/faculty/staff ratios, expenditures, degree production and efficiency because it provides key insights about how a college compares to its ‘peers.’ This information identifies areas for deeper analysis and conversations with campus leaders.

A recent article in The Chronicle of Higher Education about the difficulty selecting campus peer groups rang familiar to our work at rpk. We construct benchmarking groups for our analyses, which are distinct from the peer group lists we often receive from campuses. Our analyses intentionally include a larger group of institutions (30+) than is found in a typical peer group list (10-15 colleges) to avoid undue influence from a few institutions. Our benchmarking group will usually include some peers, but rarely all of them.

Peer groups are frequently constructed from an admissions perspective and include colleges considered to be enrollment ‘competitors.’ But rpk examines operation-related metrics, so we select institutions expected to have similar business models and economies of scale. We consider mission and size, and whether colleges operate in the public or private sector, which determines funding sources and resource availability.

So, who are your campus peers? When addressing this question, make sure to consider your institutional business model. You’ll find that this approach can ultimately lead to more actionable comparisons.