Matthew Crellin, Program Officer at the Bill & Melinda Gates Foundation, recently joined rpk’s Rick Staisloff for this latest Mission, Market, and Margin® interview looking at important shifts in the stewardship of resources in higher education. Below are highlights from this in-depth discussion; you can also check out the full webinar recording.

Note: This interview has been edited for length and clarity.

RICK: Welcome, Matt. Let’s start by having you share from your current work at the Foundation.

MATT: Thanks, Rick. At the heart of it, the team and I are focused on institutional capacities for transformation. That requires that we understand the relationship of resources to action in the higher education space, especially around equitable student success. And how strategic finance serves as a consistent lever for change.

As you know, this work is near and dear to my heart, and I’ve been very fortunate to continue that line of work and thinking at the Foundation and to partner with you all at rpk GROUP.

RICK: First things first, then. What do we really mean by strategic finance? We’ve said that strategic finance is the consideration of the return on investment generated by all institutional resources (people, time and money), and the continuous effort to shift those resources toward stated institutional strategy and goals.

This is a new lens, but it has as much to do with culture as it does with any technical approach.

MATT: Absolutely. Return on investment reflects a movement from ‘What am I spending?’ to ‘What do I get for what I spend?’ Secondly, you’re broadening that aperture to look at all of those resources. So it’s not just stuff with dollar signs in front of it, but it is thinking about that whole universe of resources that you have: people, time, money, capital, buildings. And it is really about continuous improvement.

What’s strategic finance in this space? What I would say is simply this: it’s educational purpose, phrased in fiscal terms.

– Matt Crellin

RICK: And that brings us to our framing around Mission, Market, and Margin®. Mission: What are we good at? Where do we excel? What are our strengths? Market: What is the external focus? What is it we’re being asked to do from employers, from students, from governors, from legislatures, from society at large? And Margin: How do we link those things in terms of strengths and demand in a way that lets us focus and invest in the economic engines that are driving the institution?

Now, it would be great if every single thing we do at our institutions and systems reflected something we’re good at that people want that generates net revenue. But that’s not true. And that’s okay. Myth one around strategic finance is that we should only do things that generate positive net revenue. No! We just need to understand what we’re getting for the resources we put out there, and make sure we’re creating a sustainable business model.

MATT: What’s so great about this framing is that it captures the realities institutions face, especially if they are going to sustainably realize their goals around equitable student success.

RICK: And, of course, institutions live on a continuum, as they wrestle with these strategic finance approaches. From traditional business models to a growing awareness that the business model needs to shift, to more mature applications of strategic finance.

MATT: I talk about how institutions incubate, initiate, and iterate—whether it is institution-wide or just for a student success initiative.

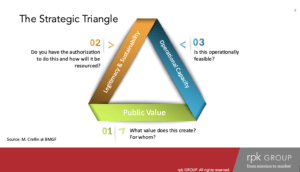

RICK: You’ve had good success lately creating engagement around your strategic triangle approach.

MATT: Thanks. It’s helped to look at sustainable approaches using three key questions. That approach could be an initiative or something larger like an academic program. In essence: What value does this create? And for whom? Two, Do you have the authorization to do this and how will it be resourced? And three, is this operationally feasible? These are simple but powerful questions that don’t get asked often enough in higher education.

RICK: Business 101 in many respects, right? I’m often struck by the fact that the basics just aren’t happening. Meaning, we launch into new initiatives and we haven’t checked on the demand—is this something students need or something employers need in terms of the market we’re serving? What will this really cost, and what’s the revenue to be generated? And then capacity – are we ready to move in this direction? So, a lot of the basic questions. If we can ask them upfront, it can allow us to make data-informed choices around what we launch into and understand what good looks like.

RICK: So Matt, how did you get into this work on strategic finance and higher ed?

MATT: Like a lot of people’s journeys, mine started when I was a college student. I was a first-generation low-income college student, and had that “Oh, my God, what is this? And how does anybody navigate it?” experience. Ultimately, those college experiences were transformative for me. But along the way, I recognized that the right questions aren’t about student failure, they’re about system failure. The transformative power of higher ed is well documented, but these benefits are not equitably spread. That realization changed my career trajectory.

RICK: You’ve used the term equity a couple of times. I bet they’re some people on this webinar that might be surprised, like, “Oh, I thought we were talking about finance.” So talk a little bit about equity and strategic finance, and how those things come together in this moment.

MATT: I think the finance function gets a little overlooked in the equity process. The CFO needs a seat at that table. That helps ensure that equity is really at the center of things, and that there are levers in place to move resources in that direction.

What’s that future state you’re looking out toward? And how does it incorporate strategic finance? That is about saying, if this is our North Star, then we’re aligning all of those resources to that.

It helps that we get to work with partners who really have an equity-first approach as rpk GROUP does.

RICK: You can see that connection or not of resources to strategy and equity throughout an institution. For example, we recently worked with an institution that made an enormous investment in their College of Business. It was a growing part of the market, and the investment resulted in more enrollments, and more net revenue. What’s not to like? Until you take it apart at a more granular level and see that students of color in that College were dropping out after their sophomore year. So, great experience and opportunity, but not a great experience for everybody. Before that institution continued to grow its business program, it needed to invest in equitable success.

Matt, I’ve been having this strategic finance conversation for 30 years. It feels now like a shift is happening in how we think about resources and outcomes. Do you think that’s true? And if it is true, why do you think that might be?

MATT: Absolutely. And I think it is first a mindset shift. Remember 10 years ago when there was a shift toward data-informed decision making? People doubled down on data, and it was not uncommon to hear the refrain of “everybody’s a data person”. There’s an analogue here to strategic finance – everybody is a finance person. Everyone needs to have a thoughtfulness and responsibility and accountability to the way that resources are used and deployed. As it becomes everyone’s job, we can democratize strategic finance.

RICK: Sometimes, I think I’m one of the few voices in higher ed saying that we don’t have a resource problem in our industry. I think we’ve got plenty of resources; they’re just not in the right places to get the job done that we’re being asked to do today.

MATT: The lever around resource allocation, reallocation—that one gets underutilized, and in many respects, actually has significant staying power for being able to do and accomplish a lot of initiatives. A great example that comes to mind is a recent CCRC study looking at guided pathways. They asked institutions how they were paying for it. In almost every case, it was about reallocating resources.

RICK: So more and more people are getting it. We see the shift. But, boy, there’s a lot of stuff that gets in our way. For example, we can’t just wait for the finance people to figure it out. Everybody has to start using this strategic finance lens.

MATT: You know, universitas—the Latin root of the word university—literally means corporation, as in company, or guild. It’s odd then that while institutions are built on the very notion of knowing, what the people associated with those universities know about the university as a corporation, is actually quite little, in the business-oriented sense of the word.

I always feel that, at heart, there are three broad aspects to running an institution:

- Supporting the academic mission through teaching and research, primarily through students and faculty outreach and community engagement.

- Leading and managing people. That’s true within any enterprise, except that you’re also dealing with specialized faculty, staff, administrators, employees of an institution.

- Generating and managing all of the resources/money that are going to pay for all of that. Unfortunately, none of these three have more mythology or less understanding than the money piece.

RICK: So, are there bright spots out there? What would you point to in terms of institutions, initiatives that looks like they’re actually working?

MATT: Two examples I want to lift up. One is Zane State College and their student success journey. They were trying to figure out some of the ROI on their guided pathways approaches. They had invested very heavily in institution-wide transformation, over about a five to six-year period, and it yielded better student outcomes. Despite that, they saw their funding from the state share of instruction decrease by about 15% in that same time period. They realized they needed to demonstrate how the increased Associate Degree completion translates into significant public value, including things like higher earnings and employment rates.

Another example that I love comes from our work with the Frontier Set: 29 institutions and two state systems that we’ve worked with since about 2016. Their student success rates and other metrics were above the average amongst their peers, and we set out to understand and learn why. In the case of Ohio’s Lorain County Community College, they involved stakeholders in resource decision-making processes, including vice presidents, controllers, other administrators, human resource directors, and finance committees. That understanding helped us lift up a high impact practice.

RICK: I’m thinking that a lot of the folks joining us today are wondering where they might start their own join journey towards a sustainable business model. What advice would you share with them in terms of where they go next?

MATT: First and foremost, draw on a data-oriented mindset, and use that data to figure out the story. The next piece is future vision – where do you need to go? Why do we need to change? And ultimately, what’s that NorthStar anchor so that we design with the end in mind?

RICK: Your points also speak to institutional and system capacities to do this work. We’re really excited here at rpk to be working with the Foundation on strategic finance capacity. Going into next year, we’re looking forward to creating some new tools to help institutions understand themselves better. Where are we on that strategic finance continuum? If we’re in this place, what do we need to do to deepen the strategic finance lens? So more to come here, but I think it’s an exciting next step.

Well, thank you again, Matt, for all of your support of the work. And for helping institutions do things to create sustainable support for students so that they have the kind of opportunities you did as a first-generation student. It’s no small thing.